At Redwood, we have always valued innovation. And as we have mentioned, through this pandemic we have become even more laser-focused on creating safe, affordable, hopeful housing in supportive community.

Our community needs more affordable housing units, and we need to be able to provide the supports tenants need to stay successfully housed.

To address homelessness effectively, we need to take the best parts of what’s happening at Lucy’s Place and scale it up to meet the need in Simcoe County.

Our community needs more affordable housing units, and we need to be able to provide the supports tenants need to stay successfully housed.

To address homelessness effectively, we need to take the best parts of what’s happening at Lucy’s Place and scale it up to meet the need in Simcoe County.

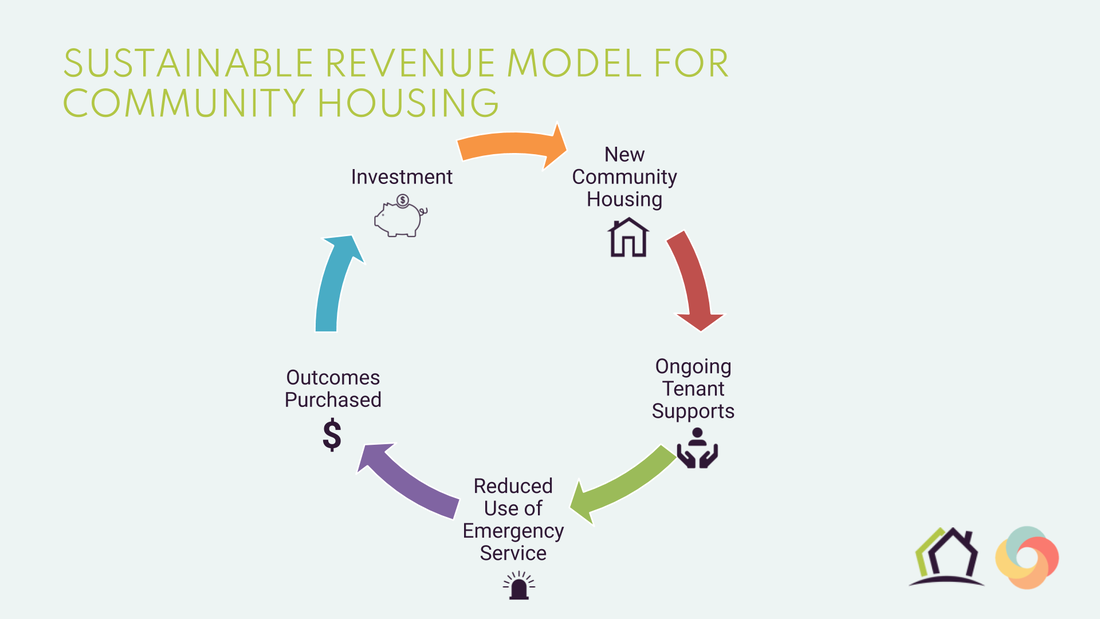

One of the main barriers to creating new housing is, of course, money. So we are investigating new financial tools beyond government grants and philanthropic donations. Specifically, we’ve partnered up with Encompass Coop from Winnipeg to create two new ideas that we intend to launch in Simcoe County:

Here’s how it works.

- A Community Investment Bank

- Outcomes Purchasing Contracts

Here’s how it works.

Community Investment Bank

A community investment bank allows investors to put their money into building valuable infrastructure, like affordable housing, in their own community, while still earning both a financial return and a social return on their money.

Instead of competing for elusive capital funding from government organizations, nonprofits and charities like Redwood can access low-to-no interest mortgages and revolving lines of credit to finance the development and construction of new affordable housing and related community infrastructure. This means capital projects like new apartment buildings can be completed more quickly and built for the needs of the tenants rather than built to fit the funder’s requirements. This results in the creation of healthier more socially connected new living spaces at a much lower cost.

Outcomes Purchasing

Once the building is built, operating costs will need to be paid for. An innovative way to pay to keep the building running and to pay for the costs of providing high-quality tenant supports, is Outcomes Purchasing.

Our friends at Encompass Coop have been using outcomes purchasing for years in the energy industry, and they’ve developed this video that explains the concept very well:

A community investment bank allows investors to put their money into building valuable infrastructure, like affordable housing, in their own community, while still earning both a financial return and a social return on their money.

Instead of competing for elusive capital funding from government organizations, nonprofits and charities like Redwood can access low-to-no interest mortgages and revolving lines of credit to finance the development and construction of new affordable housing and related community infrastructure. This means capital projects like new apartment buildings can be completed more quickly and built for the needs of the tenants rather than built to fit the funder’s requirements. This results in the creation of healthier more socially connected new living spaces at a much lower cost.

Outcomes Purchasing

Once the building is built, operating costs will need to be paid for. An innovative way to pay to keep the building running and to pay for the costs of providing high-quality tenant supports, is Outcomes Purchasing.

Our friends at Encompass Coop have been using outcomes purchasing for years in the energy industry, and they’ve developed this video that explains the concept very well:

Government as Customer vs. Funder

It is no secret that not housing people costs our emergency service systems a lot of money: especially emergency room visits and interactions with police. Building on lots of data from the At Home/Chez Soi study, and using the emergency service providers’ own estimated costs for each type of interaction, we are able to predict the amount of money that would be saved by housing 100 people experiencing homelessness on our streets.

In an outcomes purchasing model, through our supportive community housing program we supply a reduction in emergency service interactions, and the government/emergency service providers pay us for that deliverable. We can arrange contracts for a percentage of the savings generated by the supportive housing we provide, and invoice for that service. Our hope is to establish contracts with emergency service providers including police, hospitals, fire, and ambulance.

Why is this a better model?

By combining these two new powerful tools, we are able to create a sustainable financial model for both capital investment and operating cash flow for local community organizations to be the best versions of themselves to the benefit of the whole community.

This concept has already generated excitement at the local, regional, provincial and federal levels as an innovative affordable housing solution with potential for communities across the country.

Hopefully you have found this introduction to the concepts of a Community Investment Bank and Outcomes Purchasing helpful. We’ll continue to share more information as our discussions continue and we get closer to bringing these innovative financing tools to Simcoe County!

It is no secret that not housing people costs our emergency service systems a lot of money: especially emergency room visits and interactions with police. Building on lots of data from the At Home/Chez Soi study, and using the emergency service providers’ own estimated costs for each type of interaction, we are able to predict the amount of money that would be saved by housing 100 people experiencing homelessness on our streets.

In an outcomes purchasing model, through our supportive community housing program we supply a reduction in emergency service interactions, and the government/emergency service providers pay us for that deliverable. We can arrange contracts for a percentage of the savings generated by the supportive housing we provide, and invoice for that service. Our hope is to establish contracts with emergency service providers including police, hospitals, fire, and ambulance.

Why is this a better model?

- It’s sustainable. With outcomes purchasing agreements, the operations costs are not at the whim of changing governments. Right now, government funding often needs to be reapplied for each year, causing a lot of instability in the sector, for agencies, and for the people who work for them.

- It’s scalable. With outcomes purchasing and a community investment bank, we can scale the program up or down to meet the needs of our community.

- It’s cost-effective. Providing supportive housing costs less than stays in shelter, hospital, or jail. It’s also more humane, and it allows our emergency service providers to focus on the issues that they are trained and funded to provide.

- It’s community driven. This approach provides an opportunity for community members to make private investments directly into the resiliency and well-being of their own local community, and allows local social agencies the ability to focus their efforts on providing customized supports to meet individuals’ most critical needs. This in turn allows emergency service providers to focus on emergency response across the community.

By combining these two new powerful tools, we are able to create a sustainable financial model for both capital investment and operating cash flow for local community organizations to be the best versions of themselves to the benefit of the whole community.

This concept has already generated excitement at the local, regional, provincial and federal levels as an innovative affordable housing solution with potential for communities across the country.

Hopefully you have found this introduction to the concepts of a Community Investment Bank and Outcomes Purchasing helpful. We’ll continue to share more information as our discussions continue and we get closer to bringing these innovative financing tools to Simcoe County!

More Posts

Peer Supports @ Redwood

At Redwood, we believe that safe, affordable, hopeful housing is the first step in breaking cycles of violence, abuse, poverty, and addiction. We...

Sophia’s Story

Sofia's Story“I’ve got nowhere else to go.” For years, Sophia has been working 2 jobs to keep up with the bills. But after the holidays, she started...

NIMBY to Neighbour

It's almost YIMBY Week 2021! To prepare, we are sharing some additional resources that will help you champion YIMBYism within your own network....